Tulsa Ok Bankruptcy Specialist Can Be Fun For Anyone

Table of ContentsUnknown Facts About Best Bankruptcy Attorney Tulsa8 Easy Facts About Tulsa Bankruptcy Lawyer DescribedThe smart Trick of Tulsa Ok Bankruptcy Attorney That Nobody is Talking AboutWhat Does Chapter 7 Vs Chapter 13 Bankruptcy Do?An Unbiased View of Chapter 7 Vs Chapter 13 Bankruptcy

The statistics for the other main kind, Phase 13, are even worse for pro se filers. (We damage down the differences in between both enters deepness listed below.) Suffice it to say, speak with a legal representative or two near you that's experienced with insolvency legislation. Here are a couple of sources to discover them: It's reasonable that you may be reluctant to pay for an attorney when you're already under substantial financial pressure.Lots of lawyers likewise supply complimentary consultations or email Q&A s. Make the most of that. (The non-profit app Upsolve can assist you discover cost-free consultations, resources and lawful help cost free.) Ask if bankruptcy is undoubtedly the ideal choice for your circumstance and whether they think you'll certify. Before you pay to submit personal bankruptcy types and imperfection your credit report for up to one decade, examine to see if you have any type of viable choices like financial obligation arrangement or non-profit credit rating counseling.

Advertisements by Cash. We might be compensated if you click this ad. Ad Since you have actually decided personal bankruptcy is without a doubt the right strategy and you with any luck removed it with a lawyer you'll need to get going on the paperwork. Before you study all the official insolvency kinds, you need to obtain your own records in order.

Tulsa Debt Relief Attorney Can Be Fun For Anyone

Later down the line, you'll really need to verify that by disclosing all kind of information regarding your financial events. Right here's a fundamental listing of what you'll require when driving in advance: Identifying records like your driver's permit and Social Protection card Income tax return (approximately the previous four years) Proof of income (pay stubs, W-2s, self-employed earnings, income from assets in addition to any income from government benefits) Bank declarations and/or pension statements Proof of worth of your assets, such as automobile and actual estate valuation.

You'll desire to understand what kind of debt you're trying to resolve.

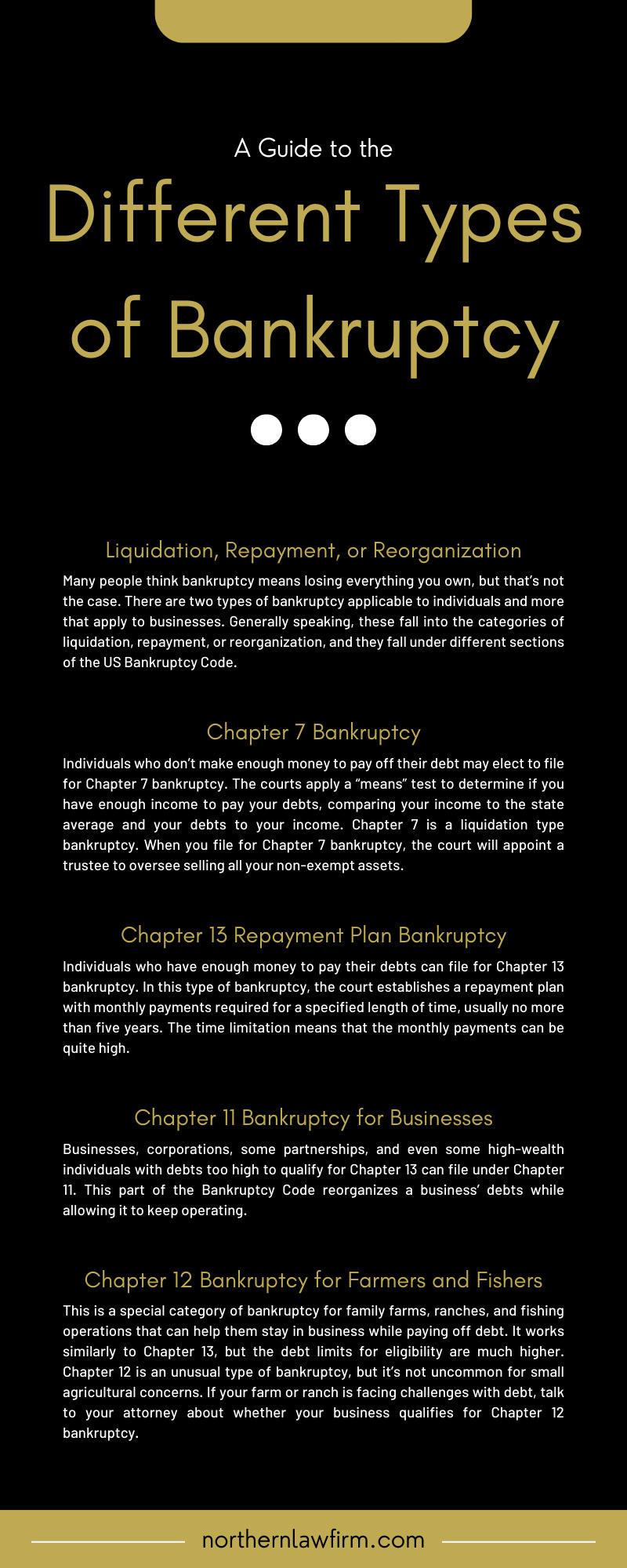

You'll desire to understand what kind of debt you're trying to resolve.If your earnings is expensive, you have one more alternative: Chapter 13. This choice takes longer to settle your financial obligations since it calls for a long-lasting repayment plan normally three to five years before a few of your staying financial obligations are wiped away. The filing process is likewise a whole lot a lot more complicated than Phase 7.

Experienced Bankruptcy Lawyer Tulsa - Questions

A Chapter 7 bankruptcy stays on your debt record for 10 years, whereas a Chapter 13 insolvency falls off after 7. Before you send your personal bankruptcy types, you must first finish a necessary course from a credit rating therapy firm that has actually been approved by the Division of Justice (with the notable exception of filers in Alabama or North Carolina).

The training course can be finished online, personally or over the phone. Programs generally cost between $15 and $50. You must complete the course within 180 days of declare insolvency (bankruptcy attorney Tulsa). Utilize the Department of Justice's website to find a program. If you stay in Alabama or North Carolina, you must pick and complete a course from a list of separately authorized carriers in your state.

The Best Strategy To Use For Bankruptcy Lawyer Tulsa

Check that you're filing with the correct one based on where you live. If your irreversible residence has actually relocated within 180 days of filling up, you ought to submit in the area where you lived the greater part of that 180-day duration.

Typically, your bankruptcy lawyer will collaborate with the trustee, but you may require to send the individual papers such as pay stubs, tax returns, and financial institution account and credit rating card declarations directly. website link The trustee that was just appointed to your case will certainly soon establish an obligatory conference with you, known as the "341 conference" due to the fact that it's a requirement of Area 341 of the U.S

You will certainly need to give a timely listing of what qualifies as an exemption. Exemptions might apply to non-luxury, key vehicles; necessary home items; and home equity (though these exceptions policies can vary widely by state). Any type of home outside the checklist of exceptions is thought about nonexempt, and if you do not provide any type of list, then all your residential or commercial property is taken into consideration nonexempt, i.e.

You will certainly need to give a timely listing of what qualifies as an exemption. Exemptions might apply to non-luxury, key vehicles; necessary home items; and home equity (though these exceptions policies can vary widely by state). Any type of home outside the checklist of exceptions is thought about nonexempt, and if you do not provide any type of list, then all your residential or commercial property is taken into consideration nonexempt, i.e.The trustee wouldn't sell your cars to quickly repay the financial institution. Rather, you would pay your creditors that amount throughout your layaway plan. A common false impression with bankruptcy is that as soon as you file, you can stop paying your financial obligations. While bankruptcy can aid you clean out numerous of your unprotected debts, such as past due medical expenses or personal fundings, you'll desire to keep paying your monthly payments for protected financial obligations if you want to keep the home.

The Of Bankruptcy Attorney Near Me Tulsa

If you're at risk of foreclosure and have actually tired all various other financial-relief options, after that declaring Chapter 13 may delay the repossession and conserve your home. Ultimately, you will certainly still Tulsa OK bankruptcy attorney require the income to continue making future mortgage payments, as well as paying back any type of late settlements throughout your payment plan.

The audit can postpone any financial obligation relief by several weeks. That you made it this far in the procedure is a decent indication at the very least some of your financial debts are eligible for discharge.